Ravensdown will exit the Australian fertiliser market and cease its Queensland operations.

The move comes five months after the completion of the sale of Ravensdown’s operations in Western Australia and South Australia and within a financial year that has seen the farmer-owned co-operative meeting its turnaround expectations in New Zealand.

Ravensdown Fertiliser Australia was set up in 2009 after cane growers invited the co-operative to start supplying soil nutrients. The original business plan based its viability on a 100,000 tonnes a year target. But cyclones, flooding and depressed world prices for sugar meant fertiliser tonnages reached only 70,000 tonnes last year.

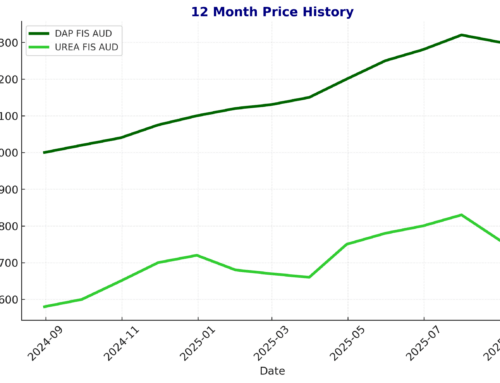

Ravensdown are concetrating on the Zealand market, by investing in advanced nutrient management training, new infrastructure such as new loaders in stores and in technology such as Smart Maps which provides a visual audit trail for a farm’s nutrient status. Ravensdown are seeing strong demand from a buoyant New Zealand sector and have good availability of products like superphosphate, DAP and urea in our stores,” concluded Greg Campbell.

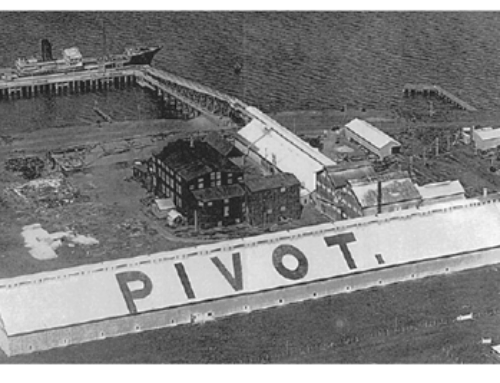

Ravensdown was created after farmers were getting frustrated by rising input costs and falling fertiliser quality. This was compounded in 1977 when the two large private companies supplying superphosphate into New Zealand creating a monolpoly. Kempthorne Prosser announced it was going to be buying its rival, Dunedin-based Dominion fertilisers,

The then presidents of the South Canterbury, Otago and North Otago Federated Farmers went to farmers in the area to ask them to become founding members of a new co-operative. Ravensdown eventually mounted a takeover bid for KP which was completed on 16 August 1978.