Australian fertiliser and explosives maker Incitec Pivot will review its local fertiliser arm (IPF) that could lead to its sale, wto appease long suffering” shareholders.

Investors have cheered a possible divestment of Incitec Pivot’s Australian fertiliser business, in the belief it could help the manufacturer avoid a credit rating downgrade and claw back ground lost to its major rival Orica. A common origin links the manufacturing of explosives and fertilisers, as both begin with natural gas being turned into ammonia, which is an intermediate product for both fertilisers and explosives. Orica has travelled a similar path in the past.

Analysts suggested the fertiliser business could be an ideal fit for the Perth-based conglomerate Wesfarmers, which owns the dominant CSBP fertiliser business in WA. While those in the industry have also speculated Nutrien could be interested.

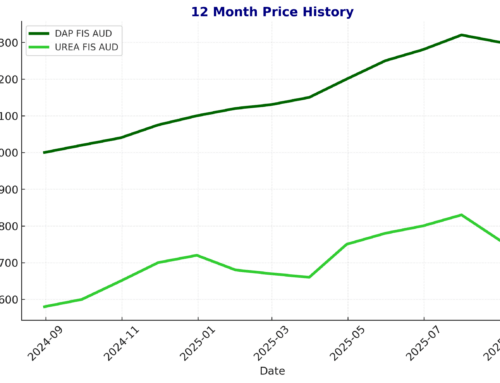

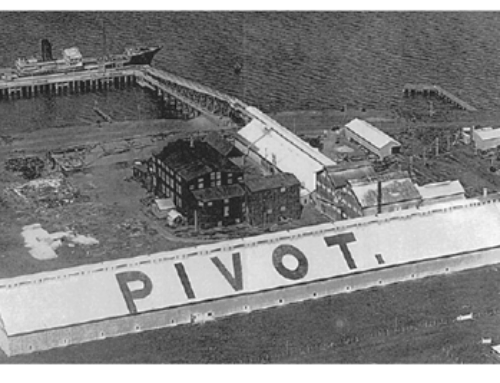

Incitec Pivot provides about two million tonnes of fertilisers to Australian agriculture each year through domestic manufacturing and imposts. IPFs Phosphate Hill (Dutchess) and Gibson Island (Brisbane Port) plants in Queensland turn ammonia into fertiliser products like urea, diammonium phosphate (DAP) and monoammonium phosphate (MAP). Incitec’s Moranbah plant in Queensland turns ammonia into the ammonium nitrate used by mining companies for blasting explosives. Incitec’s flagship Waggaman plant in the US produces ammonia for both explosives and fertiliser streams, but is currently not part of the review, which is apparently focused exclusively on Incitec’s Asia-Pacific fertiliser business.

Elders boss Mark Allison says there is potential for a national fertiliser business to emerge from the likely break up of Incitec Pivot’s assets. He said the blending facilities could help Elders fill a gap in its ability to service tropical horticulture and sugar cane growers on the east coast.

Back in September 2018 BGH went as far as to ask Incitec for a closer look at the fertiliser business, with the goal of firming up and funding an offer. It’s easy to see the attraction for a private equity owner. Incitec’s unit has a strong presence in the Australian market with its own manufacturing and distribution footprint.