WEATHER

There is a big difference in soil moisture profiles from the north to the south on the East Coast. South Australia being the worst, with the effect of the drier conditions slowly creeping north towards Dubbo. Rain falls in central and south west NSW areas have been very patchy with most growers desperate for some decent falls.

In the west WA is the opposite with the South looking much better than the northern growing areas.

There has been a lot of country dry sown on the back of the modelled long-range rain forecasts. Most areas north of Dubbo are looking great, putting them in a promising position to capitalise on a good start to their winter cropping plans.

FERTILISER NEWS – 15th May 2025

There has been some big news in the domestic East Coast Fertiliser market in the last week.

Big news is:

- INCITEC Fertiliser has been spun out of Dyno Nobel to various buyers at a tenth of the 2008 valuation. Ridleys Stockfeeds bought the fertiliser distribution business in a $300M deal . Ridleys also secured a two year $75M option over the Geelong site where single super manufacturing ceases in September this year. The Brisbane Gibson Island site which once housed Urea manufacturing and distribution, was slowly being wound down and has now sold to a property developer for $194M.

- As part of the divestment sale, Macquarie Group’s Commodities business purchased a twenty year offtake agreement for nearly 2MT p.a. of Urea, from Perdaman Chemicals and Fertilisers for $145M. That is once the new WA Urea plant comes online. The future for the Phosphate Hill mining and fertiliser manufacturing plant, south of Mt Isa is still unclear with a decision to be made by Sept25. It what is not a good sign for manufacturing in Australia, it could lead to all three of domestic Incitec’s fertiliser manufacturing plants being closed. Read more.

- WENGFU Australia Fertiliser’s Distribution business which accounts for close to 700,000tpa of fertiliser, has been bought by Fertiglobe, an Abu Dhabi-based fertiliser producer and distributor. Fertiglobe is the world’s largest seaborne exporter of Urea and Ammonia combined, and the largest nitrogen fertiliser producer. The experience and size of the Fertiglobe business is expected to increase the offering and volumes through the existing Wengfu Australian distribution sites.

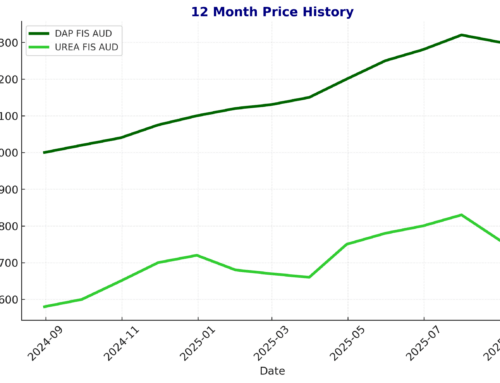

FERTILISER PRICING – 15th May 2025

Fertiliser prices over the last few weeks remain fairly stable.

The trump effect of winding back tariffs and a perceived stable government is helping the Aussie dollar claw back some ground against the USD.

Urea – the price remains flat as the market gets wiser to Indian’s tender games. Domestically the price has been fairly flat as contracting remains low.

Phosphates – AP’s have been firming throughout 2025. We are still in a situation where domestic MAP prices are below global replacement costs and this gap is narrowing with the rising prices.

The current eastern fertiliser market is trading in the following ranges:

Urea Mid-high $700’s (not much getting contracted at the moment)

MAP/DAP low $1100’s

Starter Z – very tight supply – late $1100’s (some southern port swaps are happening due to low rain fall)

SOA low-mid $400’s

SSP low $400’s (not much being contracted)

MOP has been steadily increasing, now late $600’s

SOP mid-late $1200’s – very tight supply

Feel free to contact us for firm pricing and options.