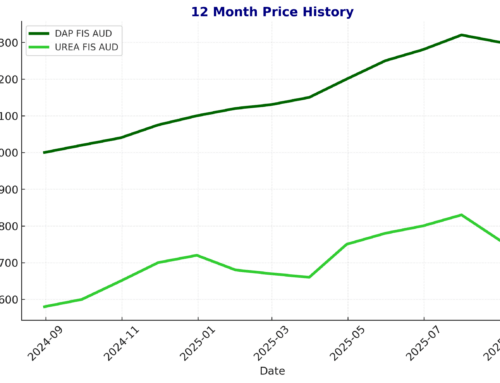

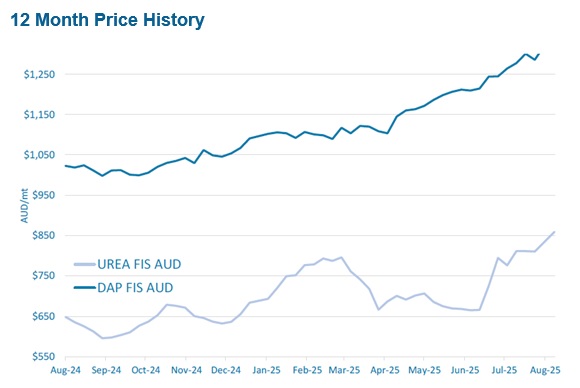

Please see a brief market wrap for the 8th August below. The insight explains the main forces that affect global and domestic fertiliser pricing. Current Australian fertiliser prices for Urea and AP’s are at the top of the range trading around Urea $880 and MAP $1300 per tonne . High fertiliser prices coupled with low commodity prices for most crops, has slowed domestic buying.

NITROGEN

Nitrogen markets remain firm.

The Indian Tender has closed at 535 USD / MT CFR India for 2,000,000 MT with an additional 600,000 MT offered but not yet accepted. With China offering tonnes to India (2 – 300,000 MT), FOB prices for Granular Urea have jumped around 50 USD / MT. Low 400’s USD / MT FOB China for Prilled moves to mid 400’s USD / MT and Granular to high 400’s USD / MT.

Technical Urea prices have been directly impacted in China, up 50 USD / MT FOB. Russian, Uzbekistan and Egyptian origins are available for spot demands. The recent tender in Indonesia secured 5,000 MT to 2 traders and any other availability is tight.

To date, Brazil has purchased 70% more Ammonium Sulphate than the same time period last year. Coupled with excess stock of Urea at port, there is negative pressure on Urea CFR Brazil. Buyers are happy to wait on Ammonium Sulphate vessels arriving unsold, purchasing at discounted rates. Note Ammonium Sulphate is trading below Urea on a Nitrogen USD / MT basis already, with limited urgency being shown. European demand for Nitrogen is weak and we should see a decrease in prices of Ammonium Nitrate and Calcium Ammonium Nitrate over the next 2 – 3 weeks during the Southern Europe holiday season.

PHOSPHATES

Phosphates, currently firm, may ease into 4th quarter. Brazil and India have begun to resist inflated offers. As mentioned in the last few updates, the local farm gate affordability in Brazil reflects a 750 USD / MT CFR Brazil price. This resistance to paying at the inflated levels could lead to a softening Phosphates market. Demand for Chinese Tech grade MAP is weak. If the export ban goes ahead as stated, buyers must purchase from other origins where supply is tight (i.e. Russian TMAP is sold out until October), or prices are high, such as Tunisia. To hedge availability and pricing risk from origins not China, we recommend purchasing some tonnes now during the open window.

POTASSIUM

Potassium prices are flat. MOP dropped in China over the last weeks, and has since been stable (although port stocks are low). Globally there have not been any significant movements. MKP is flat, but is expected to soften. SOP manufacturers are suffering in China as the local demands are yet to begin and all export avenues have been closed by banning 9.5kg bag packing formats. The global supply of SOP is very tight. A manufacturer in Egypt sold up until October, and Uzbekistan product re-building its name in the market after questions of quality.

Potassium Nitrate is firm in Chile and stable in China, although if MOP prices begin to drop, expect an easing in FOB offers.

Magnesium Sulphate ex China remains firm, however we expect to see prices fall in the next 2-3 months. Autumn season begins in China and if the expected export ban for Phosphates is actioned then Sulphuric Acid prices should weaken, decreasing the raw materials price for Sulphates.

Calcium Nitrate remains weak in China. With India unavailable as an export market, this is likely the bottom of the market until China starts focusing internally and building up inventories for local application.

FOREIGN EXCHANGE

● Little changed for the AUD over the week despite a slightly firmer USD; AUD and NZD rose 0.7% and 0.6% respectively. AUD closed the week at 0.652

● USD slightly firmer, supported by a stronger US equity market and stable macro sentiment.

● Market focus is on the RBA meeting Tuesday (expected rate cut), plus key data releases from the US (CPI Tuesday, PPI Thursday, retail sales Friday) and China (Friday).

BULK SHIPPING INSIGHTS

Pacific & Asia

● Far East / SE Asia: Rates have increased slightly on tighter tonnage and stronger demand in Australia for salt and minerals. Owners are bullish, especially on handysizes. NOPAC and steel backhauls were quiet but expected to recover.

● Middle East / Indian Ocean: Sentiment is improving, particularly on Supramaxes due to stronger South African demand. Handysize remains quiet.

● North Atlantic / US Gulf: Sentiment is increasingly bullish. More cargoes are surfacing, especially for Q3. The region is drawing tonnage away from Europe.

● East Coast South America (ECSA): The market remains under pressure with declining enquiry and tonnage oversupply. Tariff uncertainty (especially U.S.-Brazil) is weighing on the outlook.

Market Sentiment & Fixing

● Handysize: Rates supported by weather disruptions in the North Pacific and limited tonnage. Some prompt fixtures reported. Asia remains more resilient than the Atlantic.

● Supramax: Market remains weak across most basins. A few fixtures seen in SE Asia, Australia, and the Continent. Owners remain hesitant to commit forward.

● Panamax: Rates continued to soften due to oversupply. Weak North Pacific and East Australia cargo flows pressured owners further.

CONTAINER SHIPPING INSIGHTS

Trans-Pacific Eastbound (TPEB)

● Demand & Capacity: Flat demand persists in August. Carriers are operating at 70–80% of normal capacity. Overcapacity continues despite reduced service offerings.

● Operational Disruption: China ports face 2–3 day delays due to Tropical Storm Co-may. Unannounced blank sailings and bunching are impacting vessel reliability.

● Rates: The August 1 GRI and PSS have been removed due to weak demand. Rates remain soft across all gateways. Far East Westbound (FEWB)

● Capacity: Capacity in August averages 304,000 TEUs/week but will decrease to 290,000 TEUs in the second half of the month. Evergreen and Maersk are injecting ~46,000 TEUs via extra loaders.

● Rates: Spot rates have slipped slightly due to weaker-than-expected demand. However, typhoon disruptions are helping carriers maintain high utilization. FEWB rates are expected to remain elevated due to peak season backlog.

Trans-Atlantic Westbound (TAWB)

● Congestion: Antwerp faces extreme congestion (9+ days dwell), while Hamburg, Bremerhaven, and South Med ports (Piraeus, Genoa, Valencia) remain under pressure.

● Equipment: Shortages persist in Austria, Slovakia, Hungary, Portugal, and Eastern Germany.

● Rates: Most PSSs are postponed in Northern and Western Europe. GRIs are emerging for East Med routes for early September.