Pacific Fertiliser News – Nov 2025

GENERAL NEWS

Harvest is well underway with equipment and trucks making the slow journey south. The North has seen some good numbers, but yields will reduce as the action heads south of Dubbo. Stripping will slow as more rain is predicted this weekend.

Commodity prices remain under pressure for pulses, grains and cotton and the hint of dry weather seems to have many growers keeping grain on farm to see what the start of next year brings.

Livestock prices are near all time highs which is great for producers, but optimism remains flat based on the uncertainty of the long range weather forecasts.

The Ashes kicks off today which should be great watching! Especially after the quick start.

WEATHER

As Murphy has it, those wishing to harvest crops or drop hay are getting storms, and those wanting moisture for summer crops or pasture are missing the rain events.

The long range forecasts seem about as good as the new BOM website. A lot of growers are not confident in the long-term outlook, which has taken some optimism out of the market.

FERTILISER NEWS – 21st November 2025

Domestic fertiliser movements have slowed over the last month, due to harvesting, and lower than predicted moisture for summer cropping.

Currently the short term outlook for AP’s is soft/flat. Factors that could affect the price is the removal of US tariffs for fertiliser imports and future tenders for countries like India and Brazil.

Urea prices remain firm internationally, however local demand remains subdued. China is suppling extra export tonnes, but this volume should be accounted for in India’s tender. With the final tender tonnes to be confirmed next week (range 1Mt – 2Mt).

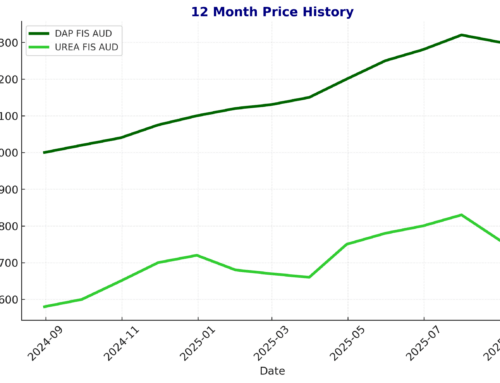

FERTILISER PRICING – 21Nov2025

Fertiliser prices over the last month have remained fairly stable.

Urea – Domestically the price has been flat and contracting remains low.

Phosphates – Domestically the price has been flat and contracting remains low. SSP price is flat but supply is tight.

The current eastern fertiliser market is trading in the following ranges:

Urea mid-late $700’s

MAP late $1200’s

DAP low $1300’s

Starter Z – very tight supply – late $1300’s

SOA mid $400’s

SSP low $500’s (limited supply)

MOP low $700’s

SOP mid $1200’s

Feel free to contact us for firm pricing and options.